Our Solutions for your Business

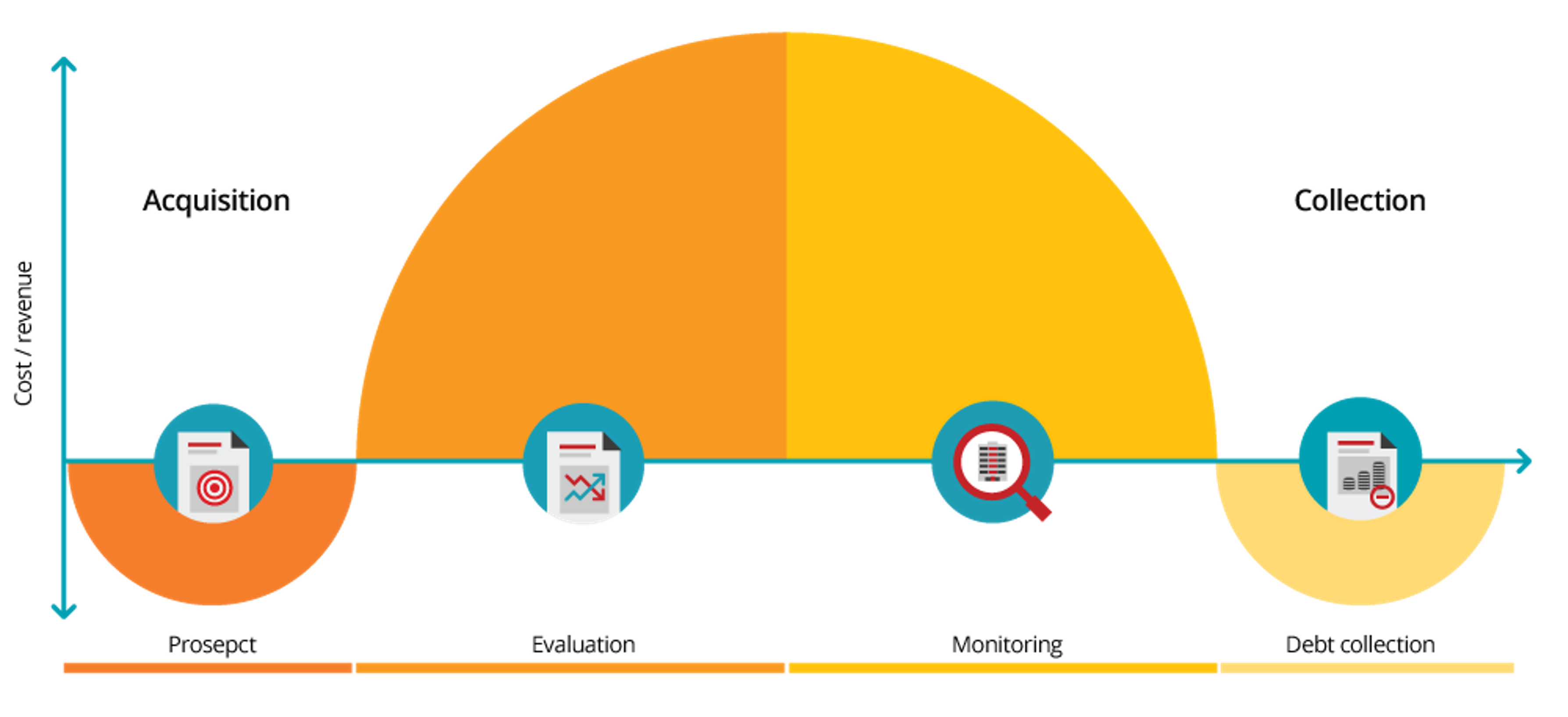

Automate and enhance your decision-making process through advanced analytics. Credit risk scorecards are statistical models used to assess your customers’ risk at each point of the credit cycle. Scorecards produce a ranking of customers by risk levels by leveraging your data. Once integrated with lending strategies, credit scoring helps to perform fast, accurate and transparent decisions. We believe that with our successful track record of similar solutions in a variety of markets all over the world, as well as the deep experience of our team, we are able to add significant value to your business.

Credit Reports

The EveryData Credit Report Plus is a comprehensive tool that increases your speed and efficiency in granting loan approvals. Inclusive of the benefits of our AI-based Credit Scoring model, Credit Report Plus draws on our credit information database to paint a complete picture of prospective borrowers' creditworthiness.

Digital Onboarding and KYC

Today’s ID-checking processes offer sophisticated, real-time verification methods so that you can quickly spot ID fraud without inconveniencing genuine customers. Our Digital Onboarding solution also brings you a completely customizable KYC process built around automated Identity Validation & Verification according to industry next and best practices.

Advisor Batch Analytics

Introducing Advisor Batch Analytics, the ultimate solution for financial institutions looking to gain valuable insights and improve risk management. This powerful tool scans our credit bureau database, analyzing your institution's portfolio to identify new marketing opportunities and data for collection.

Benchmarking Market Insights

Credit Clearance Certificates

The Clearance Certificate may be used as a requirement for integrity clearance for public office jobs, pre-employment screening, and more. This Certificate is issued to consumers as a “clean bill of health”.

Monitoring Alerts

Your customers’ credit status constantly changes, and, by monitoring these changes, you can make more-informed business decisions and identify new opportunities. With EveryData’s Monitoring service, you can enhance your risk management processes, protect yourself from losses and increase low-risk sales. You will be instantly notified of changes to the customer profile allowing you to make optimal business decisions proactively.

Instant Decision Module (IDM)

Bring decision-making in your lending institutions to a whole new level with EveryData's IDM product. This decision engine provides a fully-automated workflow with connectivity to different information sources in order to pull the data and makes recommendations on whether to approve or deny loan applications. Sign up today for access to these summarized, customizable reports, inclusive of calculated ratios, applied policy rules, recommended credit limits, and more.

Digital Onboarding and KYC

Today’s ID checking processes offer sophisticated, real-time verification methods so that you can quickly spot ID fraud without inconveniencing genuine customers.